Everything You Need to Know About Owning a Credit Card

Obtaining a merchant account might exist both expensive and challenging. This is especially true for service providers, small business owners, and independent contractors. Yet with the challenges and the expense that come with obtaining a merchant carte, more than and more people are using credit cards to make purchases every day. This makes people want to know of other alternatives on how to accept payments without a merchant account. The question is whether it is possible to accept payments without a merchant account?

The answer is aye, information technology is possible to get credit card payments without necessarily having a merchant account. Owning a merchant account is no longer the only option on the table, all thanks to third-party payment gateways. In this article nosotros lay out what is the merchant business relationship requirements and provide a list of 8 alternative ways to take credit card payments.

What a merchant account is and how it works

Allow'southward clarify what merchant account is showtime. A merchant business relationship is a type of depository financial institution account. It allows merchants to accept credit card payments online. How does a merchant account work? The entire process includes 6 stages:

- Customer purchases products/services on your website.

- Your credit card processor sends the transaction to the credit carte network (Visa or MasterCard).

- The credit card network then routes information technology to the customer'due south issuing banking concern for approval.

- Once approved, the transaction funds are deposited into your merchant account.

- And so the credit card processor transfers the funds from your merchant business relationship to your business banking concern account.

- Then, and only so, you lot can employ your money.

The first four stages take no longer than a few seconds. The 5th stage, though, normally takes from 2 upward to 14 days. Yes, you've heard it correct. It might take you two weeks to employ the hard-earned money. That'southward one of the reasons why some people prefer to apply alternative ways to take credit card payments (more on them below).

What are the requirements to get a merchant account

To open a merchant account in 2020, y'all need to provide the following documents:

- Certificate of Incorporation;

- Certificate of incumbency;

- Local documents as per visitor jurisdiction which displays company directors and owners;

- Utility nib/Bank argument/Rental agreement under corporate names proving company location;

- Valid ID copies for all company directors and owners.

There are also specific website requirements y'all have to stick to. Otherwise, your website won't compile with all the Visa, and MasterCard demands. In such a instance, your application won't be approved. Another website requirement is to create Terms & Condition and a Privacy Policy folio.

How to accept credit card payments without a merchant business relationship

The merchant applying process is not as complicated as it seems. Nevertheless, it may take a long time to become through the paper difficulties. Service providers' verification steps could be all-encompassing every bit well. They vary from the quality of your documents, site functioning(if one), type of business, and others. Don't want to open up a merchant account?

Using an intermediary is the solution for you lot.

A payment aggregator acts equally an intermediary. It is a service that collects all online funds received on account of a website, an online store, and and so transfers them to the accounts of the client company. It is what allows you to work not but with cash on delivery simply too quickly plant electronic payment acceptance.

When choosing a payment aggregator, consider the following factors:

- Security.

Payment security should exist a priority for whatever merchant.

Therefore, when choosing a payment organization, you must exist sure that it tin provide the necessary level of protection. Security methods may vary:

- Instant authorization of the customer.

- Encryption of fiscal data on the Internet;

- Special certificates.

- Payment flexibility.

- The company must have a transparent payment policy. Too, exist aware of hidden fees.

- The flexibility of recurring payments.

- Does the company provide financial statements?

- The convenience of contacting customer support.

The possibility of quick contact by phone, alive chat, email or other preferable for customer methods. Support must promptly resolve problems.

- The limitations on the maximum amount of menu payment.

- The convenience of the interface both for clients and merchants.

6 proven ways to take credit carte du jour payments without a merchant account

The bulk of these payment aggregators offering online services and each 1 of them comes with its own pros and cons. All in all, these platforms make payment transactions much easier than they ever were earlier and they save pocket-sized business concern people the agony of opening merchant accounts.

-

PayPal

PayPal is by far one of the most common and largest payment processors in the globe. It rose to its prominence afterward collaborating with eBay and many other online merchants. All you need when using PayPal is the details of your debit or credit carte and your bank account. From there you get your own secure information almost your PayPal account that y'all do not have to share with anyone.

Signing up with PayPal is free and it does not require any annual membership fees. Yous too do not pay any processing fees or service charges. If you are a small business owner, yous never have to worry about the challenges of opening a merchant account.

The benefits of using PayPal are:

1. Credit carte security. Since yous don't disclose your personal banking information, your account cannot exist hacked.

two. Flexibility. You volition never have to confront the agony of having your credit menu declined. With PayPal, you can have several bank accounts every bit well as credit and debit cards linked to them. If the first attempt fails, PayPal will request funds from your other accounts depending on your order.

iii. Information technology's free. PayPal is free of charge, and at that place are no annual membership fees.

4. Instant international transactions. You tin can send or receive money in almost any country in the world. The transfers are instant, and you can cheque your balance with ane click. This makes it significantly meliorate than other costly payment methods similar Western Marriage.

-

Square

Square is the number one pick for small business owners. Information technology does not require much paperwork and the fees charged are minimal. The Square, which is a bill of fare-swiping device, turns your smartphone or tablet into a cash annals. The card connects with the device of your choice to carry out all kinds of payments. The companies' services are especially pop in street food stands, restaurants, coffee shops, and many other small businesses. Through their Cash App, yous receive payments also as electronic invoices. Probably the main advantage of using the platform for entrepreneurs will exist synchronization with the POS organization of outlets. You lot tin accept both chip cards and NFC payments for contactless or traditional operations with chips and pin codes. Moreover, you can access your income the very next business organization day later on the payment.

-

Skrill

Skrill is the best alternative to PayPal. Some of the features that make Skrill stand up out are its instant deposits and withdrawals. The transaction fees are minimal making information technology perfect for modest business owners. With Skrill, y'all can also send text messages from your account. The system procedure payments in forty currencies. Skrill besides has an incredible referral program that allows yous to collect 10% of all the friends' transactions. To utilise this payment arrangement, you practice not demand to install anything on your computer – no programs, plug-ins, etc. A typical browser and Net access are enough.

The unabridged interface is on the official website of the company. Moreover, for personal non-commercial accounts, in that location is no committee for using the organisation. The merely limitation of Skrill is age. It is impossible to register in the system if your age is less than xviii years.

The security service scrupulously checks all user information. Therefore, if y'all enter incorrect data, your business relationship will be blocked. -

Google Wallet

If you practise not have a merchant account, you tin also use Google Wallet to receive your payments. Google Wallet is some other popular online payment service that is simple to use, condom and very fast. You can use your smartphone to carry out your transactions using Google Wallet. The service too allows yous to connect debit, credit, souvenir and loyalty cards to your account.

Google tech experts claim that when you lot pay at a shop, Google Wallet does not provide your real card details to anyone. Instead, the store receives a unique encrypted number. This arroyo allows you to go along information most client payment data secure. Besides, the service has a smart authentication office, which enables you to determine whether the device is in a safe country and decides whether to request information from the user to unlock the screen.

To pay for goods using this service, your smartphone must have an Android platform version four.4 and higher. As well, NFC wireless technology is a must. -

Stripe

Stripe has been around for a couple of years now, and it is another way of accepting payments without opening a merchant account. It has a flexible and powerful API that makes all transactions like shooting fish in a barrel to make.

The flexibility allows you to tailor the Stripe platform to your needs. Information technology is easily integrated with many other applications, which means that fifty-fifty if you are not tech-savvy, you tin comfortably start using it to do your business. Information technology has no prepare-up, or monthly fees as well as whatsoever other hidden costs. Small business owners that find it difficult to open up a merchant account will definitely dear this piece of cake-to-use platform. -

Apple Pay

Another choice to take into account if you don't want to open a merchant account but want to procedure online payments is Apple Pay. All you demand to beginning receiving online payments is a affect ID confirmation. This means that uncomplicated payment processing is literally at your fingertips. Though the platform needs a lot of improvement, information technology is by far one of the fastest-growing payment systems.

You might also like Elevation ten PayPal alternatives

How to accept alternative payment methods without a merchant account

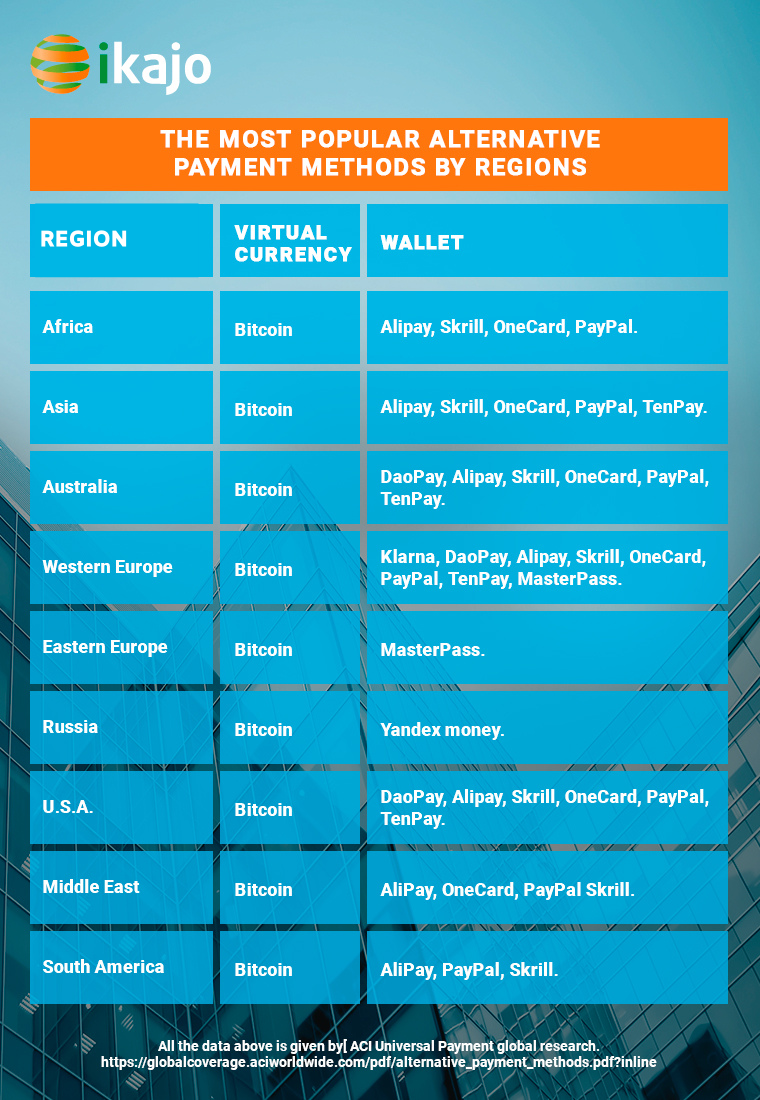

Visa and MasterCard payments are traditional. However, you should not underestimate the alternative payment methods. Alternative payment methods are cardless and cashless means of paying for products and services online. Equally stated by Industry data, up to 55% of global transactions will be made via alternative payment methods by the end of 2019. Check out the list of the most pop alternative methods by region.

The good news is, you can take culling payment methods without a merchant business relationship.

Wrapping it up

Certain affair, merchant account holders take access to a large number of avant-garde payment methods simply the approval time can exist a real pain in the neck. Depending on the payment service provider, information technology might take weeks to get approval to open up a merchant account. Besides, it is also expensive, especially for pocket-size business owners. Third-political party gateways offer the all-time alternative to merchant accounts. Though they might non come with the same advanced payment tools and services, they are affordable, fast and secure. They also give merchants the pick of managing the transactions using their mobile devices. Gateways without mobile reader solutions offering the aforementioned services via a website.

When choosing a service for accepting payments, pay attention to the simplicity of the process for connecting a payment aggregator, the convenience of the interface of your business relationship, and the time for crediting payments. An important factor is also the security of cash flows passing through the service.

Therefore, if y'all are starting upwardly a concern or are all prepare to run your own business concern but cannot beget to open a merchant account, the platforms above will bear witness you several ways how to have credit bill of fare payments without a merchant account.

Source: https://ikajo.com/blog/accept-payments-without-merchant-account

0 Response to "Everything You Need to Know About Owning a Credit Card"

Postar um comentário